In 2018 alone, criminals successfully stole around £1.2 billion from UK businesses.

- Business Compliance

- 40 languages

- 30m

Buy now

Multiple use from as little as £5.00 pp

Single use £30.25 +VAT

- Price based on an average client order. Call us for a bespoke quote

- Multiple users across this or any of our other courses

- Designated Account Manager and full phone/email support

- Full access to our product

- Single user on this course

- 60 days’ unrestricted use

- Upgrade to subscription based training any time to suit you

Learning outcomes

-

Understand and work towards compliance with the Fraud Act 2006

-

Learn what you can do as both an employer and employee to prevent fraud

-

Know how to report fraud in the right way and understand the need for a Fraud Policy

Your trial awaits!

Covered in this course

Course contents

This training course is broken down into 5 sections

-

1What is Fraud?

-

2Detecting Fraud

-

3Preventing Fraud

-

4External Fraud

-

5Reporting Fraud

About this course

Fraud can make an individual or group feel unsafe or as if their privacy has been violated. Action Fraud reported in September 2017 that around 272,980 fraud offences (in the UK alone) had been carried out in the previous 12 months.

According to the Fraud Act 2006, there are 3 types of fraud;

- Fraud by false representation

- Fraud by failing to disclose information

- Fraud by abuse of position

Preventing fraud, while increasing awareness of the topic within your business, can prevent monetary loses (sometimes major ones) as well as prevent delicate and private information being shared and distributed. This online training will provide you with knowledge on what the signs of fraudulent activity are, what to do if you encounter fraud and how to raise awareness of fraud. There may not be a strict set of rules to follow that will guarantee you or your business do not encounter fraud, but this course will equip you on how best to manage the situation and avoid being a victim of fraud.

Presented by

Other people also bought

The importance of Fraud Awareness and Prevention Training

It's important that you comply with the law and understand the positive impact this training course can have on your organisation and employees.

Find out moreAvailable in 40 languages

All inclusive

Machine translated* content is included for free with all our popular courses

It covers LMS navigation, course transcripts and test questions. If you don’t see a course listed in the language you require, just let us know.

*Content which is not English may be machine translated and is for assistive purposes only. We cannot guarantee the accuracy of translations.

Our most popular languages

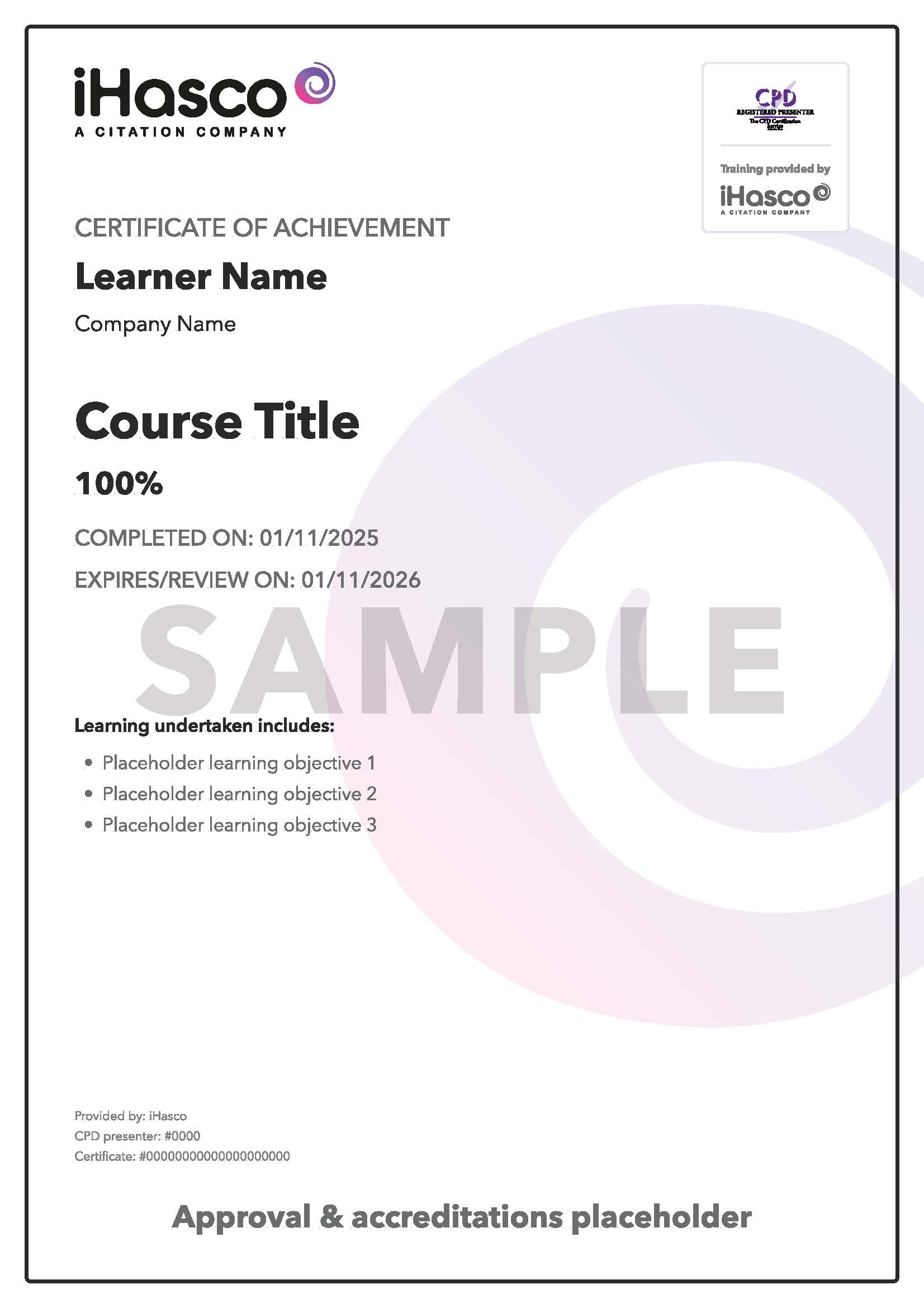

Fraud Awareness Training certificate

Download and print

Each of our courses ends with a multiple-choice test to measure your knowledge of the material.

This Fraud Awareness and Prevention Training course concludes with a 20 question multiple choice test with a printable certificate. In addition, brief in-course questionnaires guide the user through the sections of the training and are designed to reinforce learning and ensure maximum user engagement throughout.

As well as printable user certificates, training progress and results are all stored centrally in your LMS (Learning Management System) and can be accessed any time to reprint certificates, check and set pass marks and act as proof of a commitment to ongoing legal compliance.

What does this certificate include?

Your Fraud Awareness and Prevention Certificate includes your name, company name (if applicable), name of course taken, pass percentage, completion date, expiry date and stamps of approval or accreditations by recognised authorities.

Please note if you are using our course content via SCORM in a third party LMS then we are unable to provide certificates and you will need to generate these in your host LMS yourself.

554 real user reviews

4.6

out of 5

Loading reviews…

very interesting

This user gave this course a rating of 5/5 stars

Good to learn new things

This user gave this course a rating of 5/5 stars

Very good explaining how fraud works

Very good how fraud is executed

Superb & informative

This user gave this course a rating of 5/5 stars

It was much needed

This user gave this course a rating of 5/5 stars

good refresher

streight forward and clear

I thought this course was enlightening and easy to understand.

This user gave this course a rating of 5/5 stars

interesting , flowed, nice presentation.

This user gave this course a rating of 5/5 stars

Why is this training important?

Compliance

It’s important that you comply with the law and know the ways in which it affects you and the way you work.

The Fraud Act 2006 places accountability on those who commit fraudulent acts. If found guilty, a person could be liable to pay a fine or serve a prison sentence.

As an improvement on the Theft Act 1968, it aims to keep up with changing technologies and enables those who are guilty of committing these crimes to be prosecuted.

In conjunction with the Fraud Act, this course incorporates how your organisation can raise awareness of fraudulent activity with how to prevent it from occurring.

The Act provides for a general offence of fraud with three ways of committing it, which are by false representation, by failing to disclose information and by abuse of position. It creates new offences of obtaining services dishonestly and of possessing, making and supplying articles for use in frauds. It also contains a new offence of fraudulent trading applicable to non-corporate traders.

Related articles